In an investment industry obsessed with sales, marketing has long been thought of as the poorer cousin of distribution departments. It’s about time that perception was put to bed for good, says Esther Armstrong, Marketing Consultant, White Marble Marketing.

There has been one persistent and irrefutable truth over the 12 years I’ve worked in finance (first as a journalist, then as a content strategist and marketer).

Asset managers are obsessed with sales.

As a reporter, I was constantly covering the latest trading updates from investment firms or poring through the assets under management (AUM) league tables and most recent fund flow data. As a marketer, I have sat through endless company meetings focused squarely on where those mythical “growth segments” of the market reside, and how best to tap them.

And who hasn’t eagerly awaited the release of the quarterly Pridham Report to see which companies have dropped out of favour and which of them are riding the current market environment high?

As one investment manager said to me recently: “Every day is a competition.” Against your benchmark, against your peers and, very often, against your colleagues.

Fear vs. greed

Only this attitude hasn’t always served the industry well: Mis-selling scandals, lack of due diligence and poorly thought through product launches. If investing is an emotional tug of war between fear and greed, I know which one I’ve seen more of.

Then when markets are not behaving, and the top line gets hit, all too quickly the bottom line comes under attack.

Marketing resource can be among the first targets. “Strip it back to the bare essentials”, “It’s an unnecessary expense”, “We can’t justify it without seeing the return on investment”, “Do twice as much with half the budget”.

Asset management marketers the world over will be familiar with these sentiments, and some even less polite ones.

The short-sightedness of this approach never fails to baffle (read outrage) me. Reviews from the regulator in recent years have made it clear the vast majority of the UK population are still puzzled by, or afraid of, investing.

The mythical growth segment

The FCA’s evaluation of the state of the Retail Distribution Review (RDR) and the Financial Advice Market Review (FAMR), published in December 2020, found too many people hold their money in cash and this could be harmful to their financial wellbeing over the long term. State funding for people’s retirement is only going one in one direction – and it’s certainly not up! This is the mythical growth segment we’ve all been looking for.

What is needed is a consistent and correctly targeted education effort by financial services firms. We have the motive (to benefit investors and our own businesses), we have the means (our expertise and knowledge) and we have the opportunity (better data than ever and easy access to distribution channels). In Line of Duty, that’s enough to get you in front of AC-12 to answer a lot of tough questions.

The asset management industry’s very own AC-12 (the FCA) requires firms to communicate in a fashion that is clear, fair and not misleading. It also asks intermediaries to assess the suitability of their investment recommendations, and mandates that fund providers produce Assessment of Value reports annually. Meanwhile, on the continent, the EU’s Sustainable Finance Disclosure Regulation calls for a distinct lack of grey areas when it comes to labelling fund ranges as ‘sustainable’.

I can’t help but wonder if a lot of these demands could be met by asset managers putting themselves firmly in the seat of their clients.

We can start by changing our terminology.

Not a sales funnel

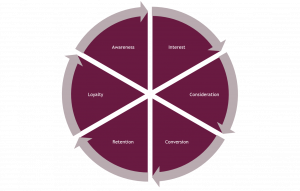

The most common stages of the ‘sales funnel’ are described as creating awareness, piquing interest, provoking consideration, and securing conversion. Occasionally, managing retention and engendering loyalty are added as an afterthought.

But when you really think about it, this is not a sales funnel at all. And, despite our command of many of the tools, techniques, and platforms to create it, nor is it a marketing funnel.

The customer loop

The customer is in charge of whether to enter into a conversation with you and can also choose when to leave. These decisions are finely balanced and can tip against you as easily as a poorly targeted email, or an off-putting social media post.

This is in fact ‘the customer loop’. The sooner we start appreciating that and acting accordingly – not least by adequately resourcing and training marketing departments to take a lead in customer experience – the better.

Is ownership of the customer journey something you’ve been grappling with? We’d love to share some more of our thoughts and help you find a relevant solution for your business. Get in touch here.