It’s something we hear mentioned often during our brand articulation and messaging work at White Marble Consulting: “People work here because of our culture; it is a key differentiator for us”.

The trouble is we hear it so frequently, we are now struggling to believe it. For a strong culture to truly be a differentiator, it stands to reason not every company in the sector can have one.

So why claim it? Increasingly – rather than a nebulous concept loosely alluded to in the annual employee engagement survey – culture is seen as the secret sauce for success in our margin-pressured industry.

Culture as a competitive advantage

Firstly, culture plays its part in the war for talent. Tough enough in the pre-Covid days, recruitment in 2023 is certainly more of a marathon than a sprint. Besides the ‘table stakes’ flexibility most candidates are looking for – remote working, hours they can move and shift around other commitments, and support during periods of change or transition in their lives – employees also want to work somewhere that feels like a cultural fit.

That doesn’t mean asset managers’ cultures need to be cookie-cutter but it does mean they need to be open and transparent about who they are and what they stand for, in order to attract people with similar values and attitudes.

The role of culture within brand

Unearthing this sits at the core of our brand articulation projects where, through in-depth discovery interviews, we get to the nub of what is authentic to a business and therefore what they can hang their hat on in market: not simply what they do but how and why that matters.

We often supplement this with quantitative culture audits where we survey a larger group of employees to ascertain the current and desired culture of a business, and whether it is accurately reflected in their brand personality and tone of voice (an internal perspective, looking out).

Some clients opt to conduct market research too, for which we question clients or prospects to determine if brand promises are realised in practical interactions with a company (an external perspective, looking in).

Beyond the management of talent and the additive role culture plays in brand articulation and brand experience, another reason for businesses to wrap their arms around the culture question is productivity.

Culture and the bottom line

Recent studies from The University of Warwick and The University of Oxford’s Saïd Business School, among others, have found happy workers to be 12% and 13% more productive respectively.

These findings are particularly pertinent in the context of what has been referred to, somewhat ominously, as the UK’s ‘productivity crisis’ – or its ‘productivity puzzle’ to more upbeat publications.

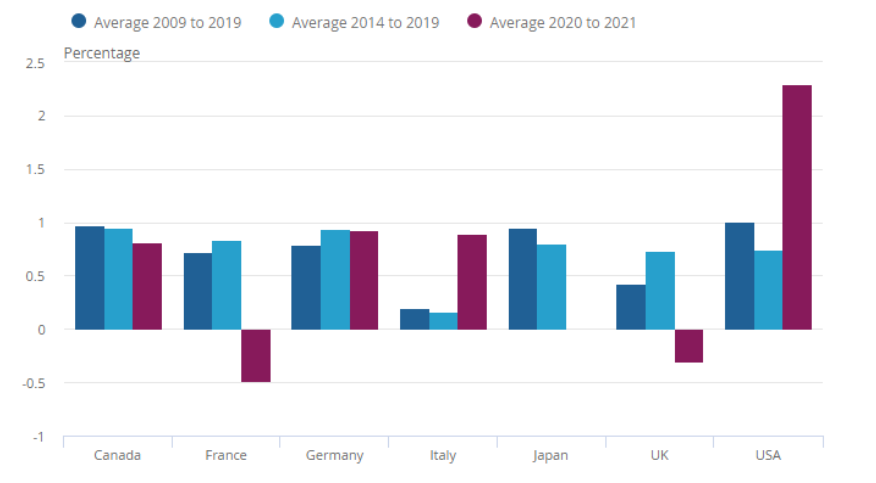

The stats speak for themselves. In January the Office for National Statistics (ONS) revised a previous announcement in stating: “Rather than having the fastest rise in output per hour (with the exception of Japan) in 2020-21, the UK had fallen to second bottom of the G7 league table on this measure”, with “only France” delivering worse numbers.

The ONS added that the average output per worker for the G7 nations (excluding Japan and the UK) was 16% above the UK level in 2021. Over a longer period the picture is no rosier. Since 2009 the UK has consistently lagged behind its G7 counterparts in average output per hour.

Average output per hour growth

Against this backdrop – and with the added challenge of making hybrid working effective now it is the norm, not the exception – asset managers are ever more aware of the need to deliver top-class CX more efficiently, to justify the margin they earn.

Culture’s role in the success or failure of M&A

Ironically, one of the trends fueled by the margin squeeze across the industry - greater consolidation through mergers and acquisitions to achieve economies of scale – is having its own detrimental impact on company culture, which in turn is one of the key predictors of the long-term success or failure of the merged entity.

It is clear margin pressures and the trend of intensified M&A are not going away. More thoughtful consideration of workplace culture during the due diligence phase of a deal, or (in the event that ship has sailed) greater communication and a proactive approach to creating a generative corporate culture post-deal, are therefore vital.

Ultimately, what we are seeing in our consultancy work is that not all cultures are created equal, but that all roads are leading to the prominent role culture has to play.

To chat to us about culture and its evolving role in the success of asset management businesses, get in touch.

Missed the last episode of the Investment Marketing Scoop? Read it here: