I have an interesting relationship with social media, as we all do these days. As a parent, I have spent at least 10 years explaining to my kids that the number of likes on your Instagram post has NOTHING to do with real life. It doesn’t equate to real friends, your ultimate happiness or success as a person.

Yet, in my professional life, we spend hours helping our clients be more effective with their digital marketing: to get more followers, more engagement, better reach. As I said: it’s an interesting relationship…

While I tell my kids not to compare their number of followers, likes or shares with that of their friends (or I resort to turning the internet off at its source in my house) it’s a slightly different story for our industry. Not only is it imperative that asset managers have a strong digital presence, but it is crucial for them to measure the efficacy of what they’re doing online.

Sometimes you have to compare

Over the past decade – and especially since the pandemic – most asset managers have been investing in their digital activity. And while one of the big benefits of digital spend is your ability to track what it does, a major frustration for our industry has been the lack of an appropriate benchmark. It’s one thing to see how many likes and comments your post got, or how many people opened your email. But how do you know if your numbers are poor, average or fantastic?

Asset managers struggle with this, because for a long time there was no industry measurement mechanism. Trying to compare yourself against ‘financial services’ firms as a catch-all also doesn’t work: pension funds and advisors looking for investment strategies are not the same as customers looking for a bank account.

As this has been a challenge in our industry, we decided to start measuring digital marketing performance, allowing asset managers to see how their performance compares against their peer groups.

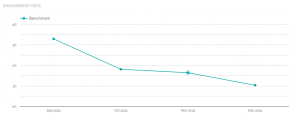

This has been invaluable for our clients. For example: our peer group of firms saw that LinkedIn engagement was down across the board in the last four months of 2021. Email open rates were down too.

While it was reassuring for firms to know it was an industry-wide trend, this data is even more valuable when we put these points into context.

Our peer group of investment marketers is empowered to make decisions based on our robust data set across multiple KPIs. We also discuss these industry trends at quarterly meetings, effectively forming a community forum among a peer group of asset managers. We get to grips with why certain trends may have occurred and how we should react to similar situations in the future.

How does it work?

Our digital marketing performance service has been around for several years, continuously evolving to stay ahead of our clients’ needs. Beacon incorporates metrics around your website performance, email list metrics, content performance and social media. It compares your performance data to a group of peers of your choosing.

This helps teams with informed decision-making based on real data and industry trends. It enables you to improve your marketing and performance and priortize your focus and spend.

While the data is robust and the platform easy to use, it is the human element which enriches the output. With our community sessions and platform, marketers can talk to their peers about the most critical issues in marketing.

By combining the story with the data, firms can make the best decisions going forward.

Just like I tell my kids: there is more to the story than just the number of followers.

If you would like to know how these data points come to life, please get in touch here to schedule a brief demo.